The digitalization divide – are there A-Teams and B-Teams among today’s finance departments?

A survey of over 200 CFOs reveals major differences in how far today’s companies have come in digitalizing and automating their finance operations. In this article, we take a closer look at how efficiently finance departments manage invoicing and payments, and what happens when common blockers aren’t addressed. Ready to compare your own processes against the rest?

If you want deeper insights and benchmarking data from the full survey, you can download the CFO Report here.

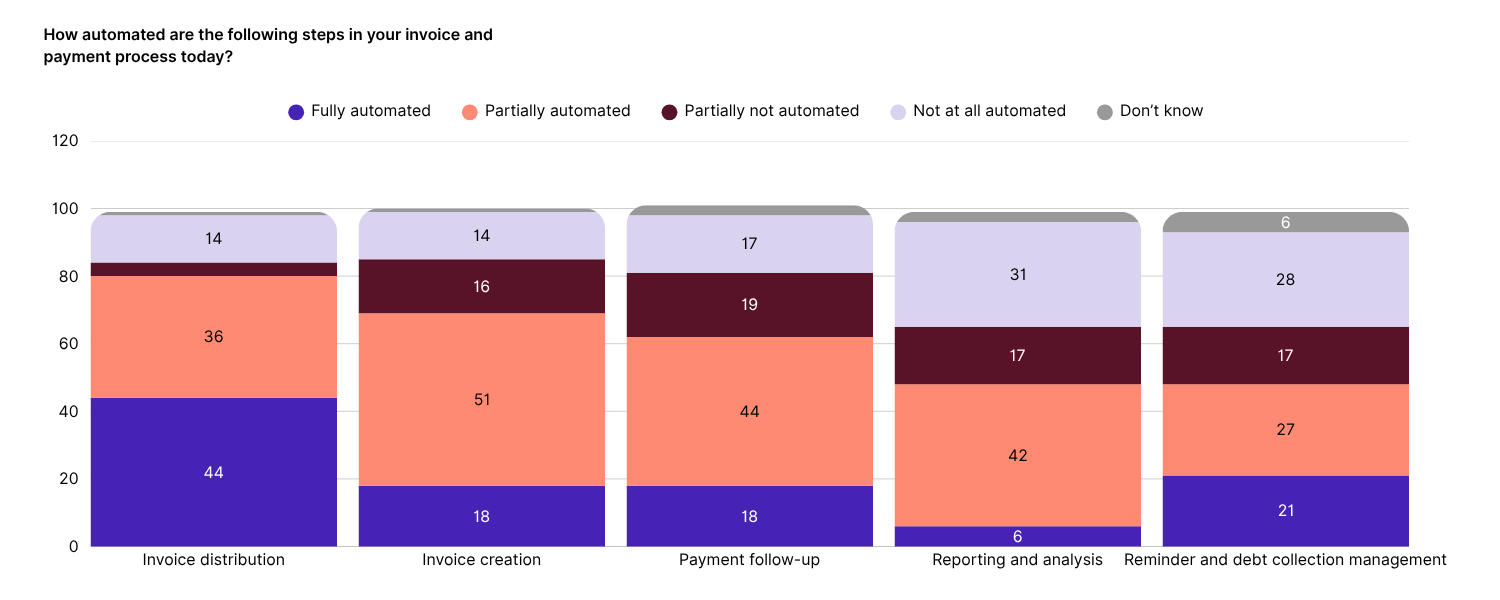

Invoicing and payments: The most and least automated steps

The survey, conducted by Novus on behalf of Billogram, shows that most finance departments in Sweden have achieved a high degree of automation in their invoicing and payment processes, especially in the early stages, like invoice creation and distribution.

However, dunning and collections, as well as reporting and analytics, are still at least partially handled manually in many organizations. There’s also a subset that’s falling behind: 14% report having no automation at all for invoice creation and distribution.

Legacy systems vs. “Born Digital”

It’s clear there are major differences between finance departments when it comes to invoicing efficiency. But what’s behind this gap?

Magnus Ekenstam, Value Engineering expert at Billogram, has extensive experience helping companies across industries optimize their internal invoicing and payment processes. He believes much of the gap stems from how different companies’ system environments are structured.

“Older companies in particular often struggle with rigid legacy systems and on-premise setups. Sometimes they try to modernize by patching new solutions onto old systems, which rarely works well. But since IT teams are often tied up with more pressing projects, the finance department is left making do with what they consider ‘good enough.’”

At the other end of the spectrum, things look quite different:

“You’ve got companies that are new enough to be ‘born digital.’ They’ve built agile, efficient digital infrastructures from day one, often using SaaS solutions. A great example is the energy challenger Rebel, which has a clear strategy of avoiding legacy tech.”

Invoicing: Less than a day or a full workweek

The digitalization gap is also evident in how long it takes to complete a typical invoicing run. While just over half of CFOs in the survey say it takes less than a day, nearly one in four report that it takes at least three days. For 7%, the process exceeds five days, effectively spanning a full workweek.

“Half a million invoices in a few hours is no big deal today”

So what counts as a fast invoicing run? Magnus notes that the perception of speed depends on what you’re comparing it to:

“I’ve seen companies that improved from taking over a week to finishing their invoicing run in two to five days. That’s a huge improvement for them, of course. But it’s still the Stone Age compared to pushing out half a million invoices in just a few hours, which is perfectly doable with today’s modern solutions.”

Magnus explains what typically slows invoicing down:

“In traditional setups, invoicing has been handled through large, file-based batch runs. All data is sent at once, and the smallest error can bring the whole process to a halt. That leads to time-consuming troubleshooting, crediting entire invoice batches, and unnecessary calls to a stressed customer service team.”

But there are ways to eliminate those frustrating bottlenecks, he continues:

“With a modern, API-based invoicing platform, the flow is much more resilient. If a few invoices contain errors, you don’t have to pull the emergency brake on the whole run. The valid ones go out as planned, while the problematic ones are flagged in real time and handled in parallel, often automatically via predefined workflows. The result? No disruptions for your customers, less pressure on support, and uninterrupted cash flow.”

Inefficient Invoicing = A growth barrier

Beyond saving your finance team time and frustration, what do companies gain from streamlining their invoicing? One way to answer that is by flipping the question: what are the risks of not doing it? One major risk is stunted growth.

“Your company might have ambitious plans to scale operations, expand into new markets, and develop new products. But then you realize your invoicing and financial systems aren’t flexible enough to support those plans without launching a massive IT project. So you scrap them. Or you push ahead anyway — with a workaround that only increases complexity.”

That brings us to another recurring pain point CFOs mention in the survey: lack of system integration. Because if your business and finance systems can’t communicate seamlessly, how can your finance team capitalize on the efficiency gains promised by AI tools and other innovations?

Don’t miss the article “Better Integrated Finance Systems: How to Succeed”, where Magnus shares practical tips on how to upgrade your system landscape without launching a major IT overhaul.

Don’t forget to download the full CFO Report

How does your finance department compare when it comes to efficiency, digitization, and automation? The CFO report gives you benchmarks from over 200 finance leaders.

Download the CFO Report.