Why implementing a payment platform is not a massive IT project

Most companies recognize the value of streamlining their internal invoicing processes and providing customers with a smoother payment experience. The question of why to invest in a digital payment platform is rarely the sticking point; rather, it's how to go about it. The fear of a gigantic IT project is constantly present. In this blog post, we explain why this concern is unfounded and answer the most common questions about our implementation process.

At Billogram, we have implemented our digital payment platform for a range of small and large companies across various industries. All share the same goal: to save time through automated invoice flows and reduce churn through better customer experiences. The path to achieving this can, however, look a little different. We adapt the implementation process to each company's needs and conditions – from us driving the project hands-on to us taking on a more consultative role. The purely technical parts are handled by us based on several well-proven approaches, which you can read more about below.

How long does it take to implement a digital payment platform?

Implementing Billogram's platform can take anywhere from two weeks to a few months, depending on your circumstances. Some factors that affect the timeline include:

Your company's size

The complexity of your payment processes

Any existing agreements with other suppliers that need to expire

What is required of your company to implement a payment platform from Billogram?

Again, it depends on your circumstances; you can choose to be very involved or delegate most of it to us. Which approach suits your organization best is determined by your wishes and needs, as well as the internal resources – especially within IT – you have access to.

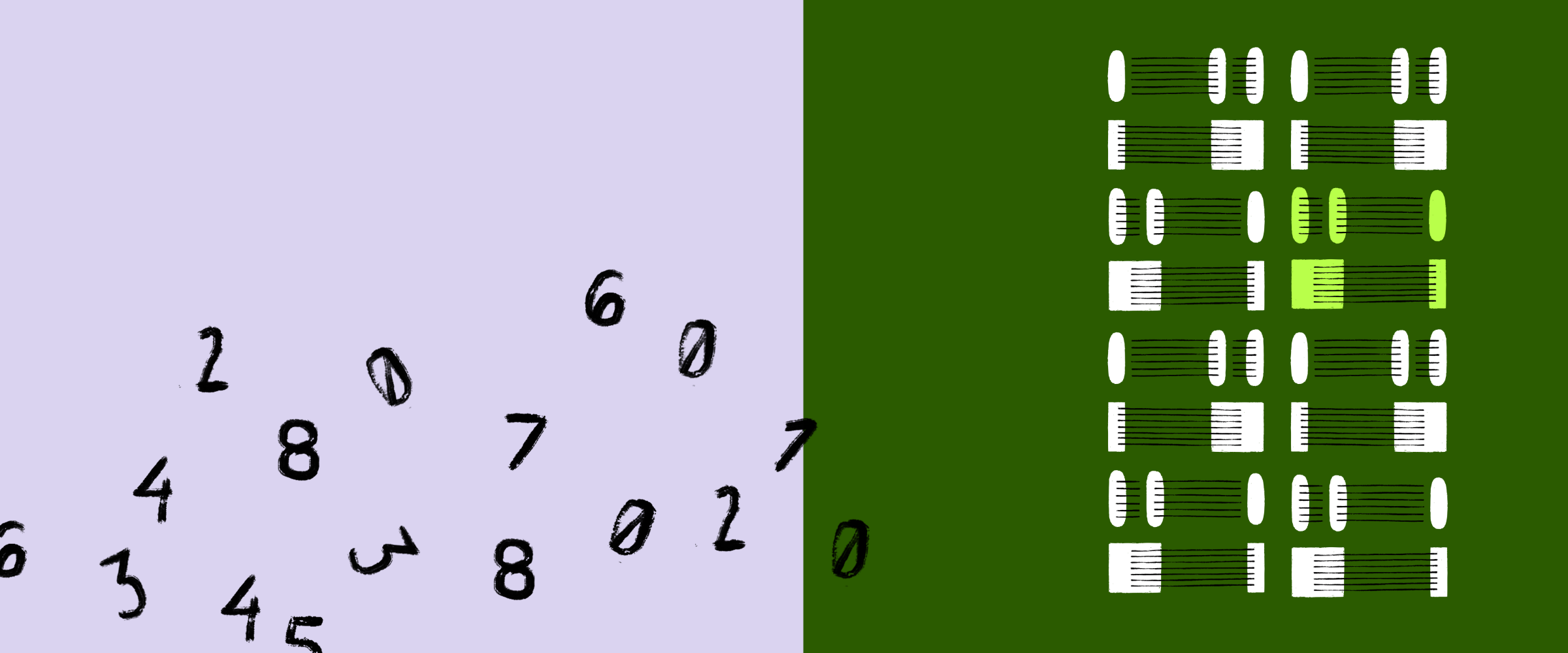

3 types of integrations – choose the one that suits you best

At Billogram, we offer three main integration options for implementing our platform. Your choice doesn't have to be set in stone forever, however. You can start with one of the simpler options and build on more components for a more advanced solution later on.

1. API Integration

This option provides your company with the broadest possibilities. With the help of Billogram's well-developed APIs, you own the integration entirely and can customize your automated invoice flows exactly as you wish. For example, the platform can be integrated with your existing business system, allowing you and your colleagues to control all functions via the interface you are already used to working with. All changes from you or your customers – such as an incoming payment or a correction to an incorrect invoice – are also updated in real-time.

2. File Integration

Unlike an API integration, data transfer with a file integration does not occur in real-time. Instead, text files in standard formats are exported and imported between different systems, so that, for example, invoice payments are compiled into a single file and entered into the accounting system once a day.

3. Hybrid Integration

As the name suggests, this is a kind of middle ground between file and API integration. Hybrid integrations involve a collaborative effort where you send your files, create invoices, and so on, and then Billogram reports back via API. You don't need to build the invoicing engine and invoice flow yourself, but you still get real-time reporting, which facilitates, for example, customer service inquiries.

Tips for those who want to know more

Do you want to know more about how the implementation of our platform works and what factors you need to consider to choose the right type of integration? Download this useful guide, where you will also find examples from companies that have chosen the different options.

You are, of course, also welcome to contact us at Billogram directly with your questions and concerns.