Martin Svane

How CFOs are navigating efficiency, automation and fear of change

In a survey among CFOs, conducted by Novus on behalf of Billogram, 7 out of 10 say they are satisfied with the overall operational efficiency of their companies’ finance departments. However, the CFOs still see room for improvement – mainly within reporting and budgeting, as well as invoicing and payment follow-ups. And their top priority for the near future? Efficiency gains through digitalization and AI.

We let two industry experts reflect on the survey findings and the current transformation of financial operations: Dennis Lodin, CFO of Universum and founder of Agenda CFO, with 20 years of experience in the field, and Rasmus Lidh, Finance Manager at Sappa, that represents the new generation of financial leaders. In this article, they share their thoughts on the challenges and opportunities facing the modern CFO.

For a more in-depth discussion, watch our recorded webinar: The CFO role in times of transformation.

Financial efficiency: perception vs. reality

The fact that 70% of CFOs claim to be satisfied with the efficiency of their operations surprises, and even provokes, Sappa’s Rasmus Lidh:

– Are they really efficient, or are they just doing things the way they always have been? I think an older generation of CFOs might have a different frame of reference around what an efficient process actually is. But as a CFO, you have a responsibility to develop your operations further. You can’t be stuck with the processes you’ve worked with for twenty years.

Dennis Lodin, as a more senior CFO, agrees things aren’t moving as fast as they could:

– A lot of companies are still relying on spreadsheets and manual work. It’s one of the main challenges for finance departments today.

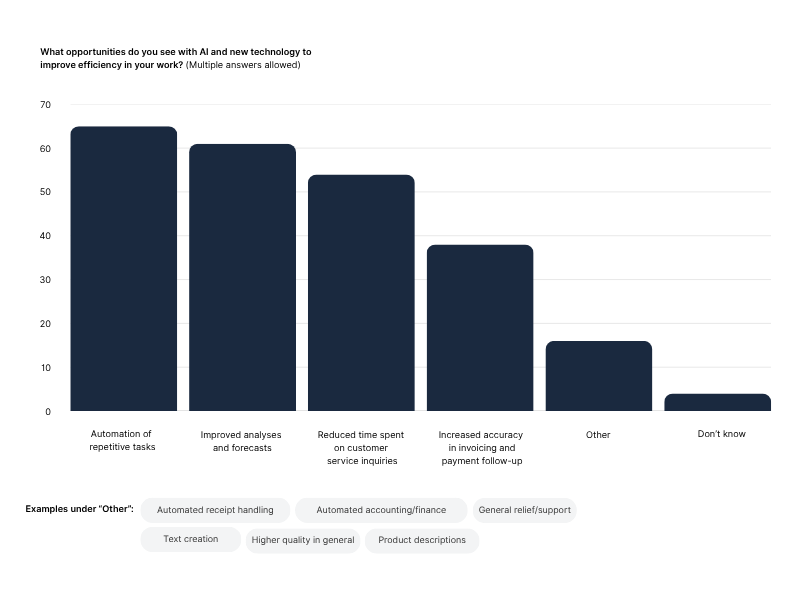

Like the CFOs in the survey, Dennis and Rasmus see a lot of potential in using AI and automation to reduce internal administration and human error. The freed up resources would allow CFOs and their teams to take on a more strategic role:

– The more you can get generic and manual tasks off the table, the more time you’ll have for understanding and enhancing your numbers. That’s where you’ll provide real value to the business, Dennis explains.

Example from the CFO report based on our survey, highlighting the perceived potential of increased efficiency through AI.

The fear of change (and how to overcome it)

So what’s stopping financial departments from implementing solutions that could automate more tasks and improve efficiency?

– I think it's a matter of being too comfortable and not wanting to change or seek new solutions. Another important aspect is that becoming more efficient means you’ll need fewer resources. This could be perceived as a risk by people who are afraid of losing their jobs, says Dennis.

The CFO needs to help their team understand the value of the transformation, says Rasmus:

– You have a responsibility to make people feel secure as your organization goes through changes. For example, automating tasks can free up time for employees to do more interesting things, or climb the career ladder.

From firefighting to future-proofing

Development initiatives can also be put on hold because internal resources are busy solving more urgent problems. But focusing on “putting out fires” is not a healthy strategy in the long run:

– You have to find a way to set aside time for development. If you succeed, it will give you a competitive advantage, says Rasmus.

His advice to make it happen?

– Make an inventory of your key processes to see which ones you can improve and work closely with your IT department on the projects you decide to prioritize. For example, at Sappa, we’ve managed to automate our processes for accounts payable and accounts receivable. Our partnership with Billogram has played an important role in getting rid of time-consuming manual processes.

Dennis also stresses the importance of collaboration:

– The finance department is not an island. You have to work with the rest of your organization at all times. The sooner you break down barriers between departments, the better.

On-demand webinar: The CFO role in times of transformation

Watch our recorded webinar to get more insights from Dennis and Rasmus, as well as from Billogram’s Value Engineering expert, Magnus Ekenstam. Enjoy!

Martin Svane