Better Integrated Finance Systems: How to Succeed

Finance departments want efficiency, and AI is supposed to deliver it. Or is it? A large-scale survey shows that today’s CFOs have high hopes for AI, but that manual processes and poor system integration are slowing progress. So, is it possible to upgrade your system landscape to enable seamless data flows and leverage AI, without overwhelming your IT department? Yes, it actually is. Magnus Ekenstam, Value Engineering expert, explains how.

Finance automation is progressing, but the digital divide remains. Many companies have made significant strides in automating their finance operations. Still, a notable digitalization gap remains between those at the forefront and those lagging behind. These findings come from a survey of over 200 CFOs, conducted by Novus on behalf of Billogram.

The survey also highlights specific areas where CFOs in digitally mature organizations still see untapped potential for further efficiency gains. Most notably: reporting, analytics, budgeting, and forecasting—processes that are also cited as some of the most time-consuming in finance departments today.

Tip: Download the full CFO report to explore benchmarks, insights, and in-depth analysis from the survey.

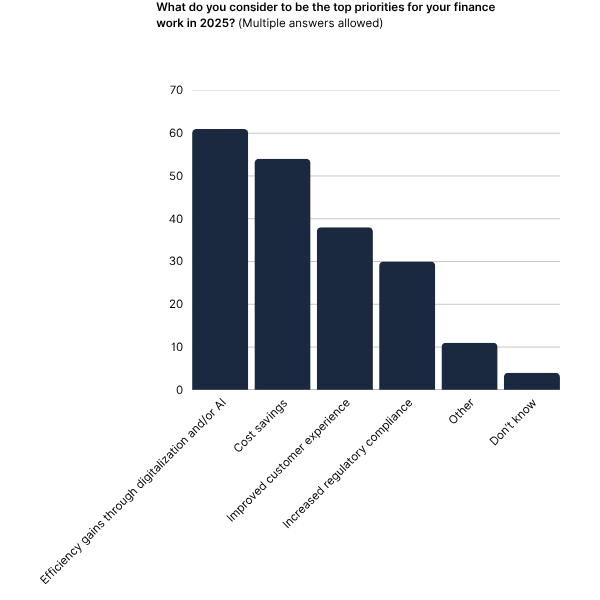

AI-driven efficiency tops the CFO priority list

The CFOs surveyed expressed high hopes that AI will help them reach the next level of automation. In fact, efficiency through digitalization and AI, closely followed by cost savings, emerged as top priorities for finance departments in the coming years.

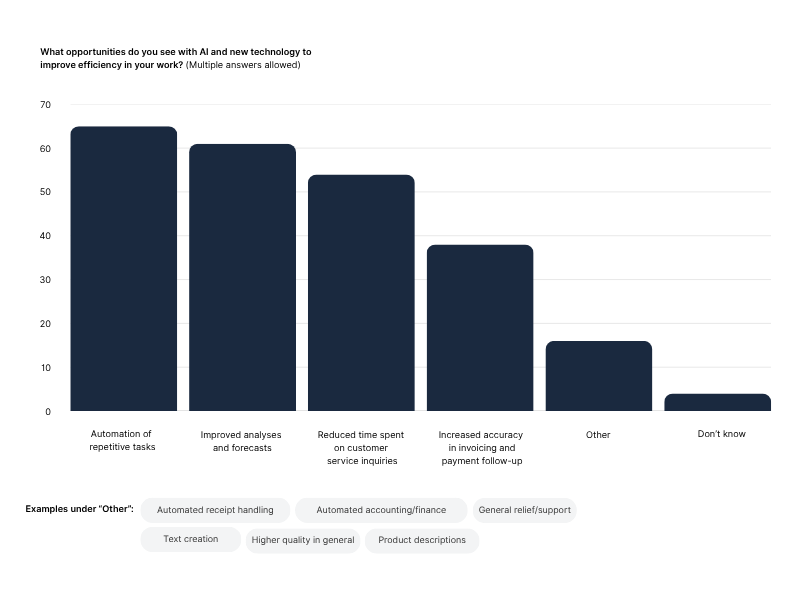

The greatest perceived potential lies in using AI to automate repetitive tasks. But CFOs also see opportunities to work more intelligently with complex activities, such as forecasting, analysis, and even customer support.

Magnus Ekenstam, Value Engineering expert at Billogram, agrees that there’s still significant potential to streamline corporate finance operations:

“Despite recent years of digitalization, many companies still rely on inefficient manual processes—especially older organizations with complex IT infrastructures,” he says.

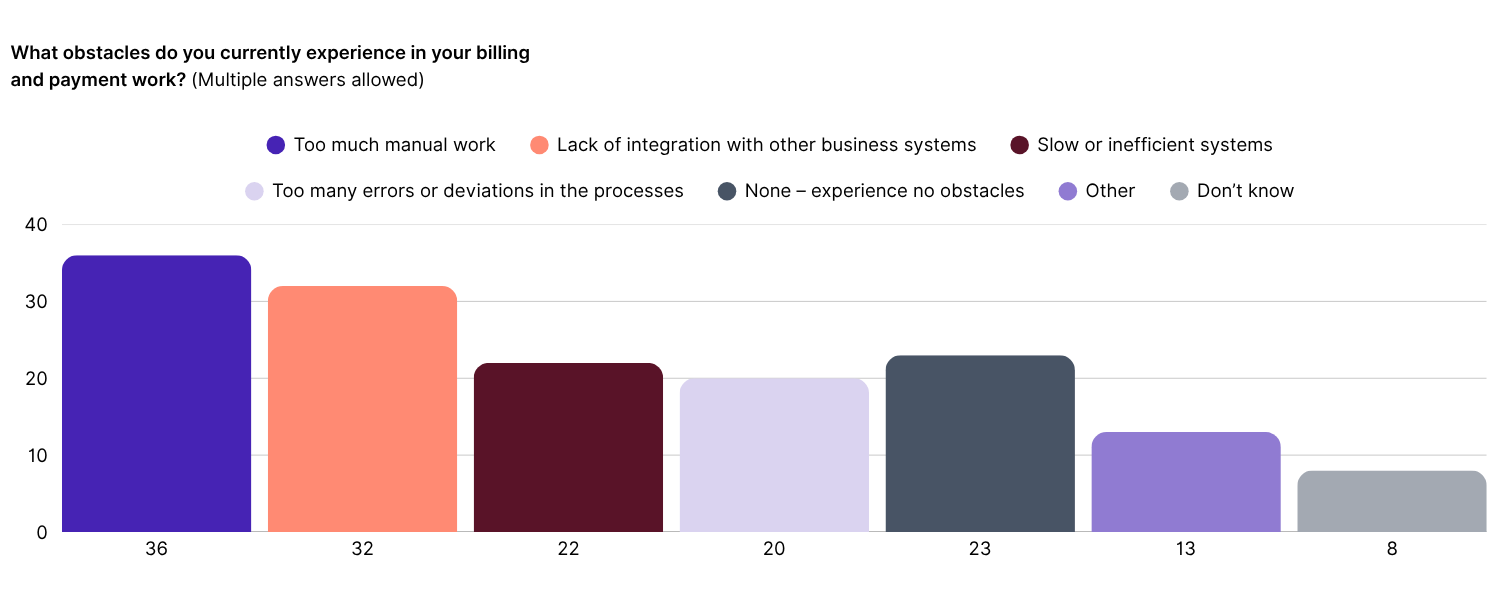

Fragmented systems are stalling efficiency gains

While CFOs express strong optimism about AI, one recurring theme stands out in their survey responses: lack of integration between systems. Around one in three say that manual processes and poor connectivity with other business systems are limiting the efficiency of their billing and payment operations. Roughly the same number point to easier integration with existing systems as a missing feature in their current invoicing solution.

“Garbage in, garbage out” – no AI gains without clean data

That CFOs see system fragmentation as a barrier to automation doesn’t surprise Magnus Ekenstam. And it’s not a challenge that AI can magically solve, he notes:

“To tap into the full efficiency potential of AI tools, you need to work with data points in a smart and structured way. If not, you won’t be able to cut out manual steps in your billing and payment workflows—or generate reliable reports. It’s the classic ‘garbage in, garbage out’ scenario.”

Maintaining clean, accurate data over time is easier said than done, he continues:

“Most companies try to keep their databases updated, but they rarely trust the data to be fully reliable. As a result, they still end up using spreadsheets and manual workarounds—even after investing in expensive systems.”

What’s behind this disconnect? One reason is that companies often receive data from a wide range of sources and formats, or lack key data points altogether.

“This is a common challenge in traditional billing setups, where one provider handles distribution, another handles collections, and so on. When data from these different vendors and processes flows into an already messy system architecture, it becomes very difficult to maintain control,” Magnus concludes.

“Switching ERP systems is almost like heart surgery”

So, what does it actually take to enable smarter data flows and unlock the potential of AI and automation? Do you need to overhaul your finance tech stack entirely?

Magnus argues that such a drastic move is rarely a viable option, especially for companies that have built up a complex IT infrastructure over time, with their ERP system at the center. Make a change there, and countless other processes may be affected.

“If your company has more than 15 years of invoice and customer data, switching ERP or CRM systems is almost comparable to heart surgery,” he explains.

Some companies try to avoid such disruption by creating a long-term roadmap that spans several years, gradually building a new system before retiring the old one. But according to Magnus, this parallel approach comes with a heavy price tag.

“These kinds of projects tend to drag on forever. They almost always take longer than expected. And while you're still working on implementation, the world keeps moving—so your ‘new’ system risks being outdated before it’s even fully deployed.”

Why it pays to outsource your billing and payment operations

A more manageable route to modernization, Magnus says, is to break things down, piece by piece.

“Think of it like a tower made of wooden blocks. If you pull out ten pieces at once, the whole thing will collapse. But if you remove one at a time, you can dismantle the entire structure without chaos. The same goes for internal processes. Identify the non-core functions, and outsource as many of them as possible.”

One such non-core process that’s often worth outsourcing is billing and payments—or Invoice-to-Cash (I2C), as it's commonly known.

“By shifting to an API-based SaaS solution, you can integrate seamlessly with your existing systems. You avoid launching a massive IT project while still gaining real-time automation across every stage of the I2C flow,” says Magnus.

He adds that SaaS is also far more cost-effective than running and maintaining on-premise setups:

“Many still believe outsourcing is expensive. That might’ve been true 20 years ago—but not anymore.”

Freeing up internal resources also creates significant value, Magnus points out:

“How much does it cost to have a senior controller spend several working days a month fixing invoice errors or managing direct debit sign-ups? And what could that person achieve instead if those tasks were taken off their plate?”

Guide: How to implement a modern billing platform

Curious about how to implement a smooth, future-ready invoicing solution that fits your company’s digital infrastructure?

Don’t miss our practical guide—it walks you through the different implementation paths and what they entail. Download the guide here!